MFA Financial, Inc. (MFA)

9.9700

+0.2100 (2.15%)

NYSE · Last Trade: May 4th, 2:50 AM EDT

MFA stock results show that MFA Finl missed analyst estimates for earnings per share and missed on revenue for the first quarter of 2024.

Via InvestorPlace · May 6, 2024

Via Benzinga · November 21, 2023

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Via Benzinga · June 7, 2023

Stocks are up today and it's thanks to investors celebrating recent positive news concerning the ongoing banking crisis.

Via InvestorPlace · March 27, 2023

Via Benzinga · February 3, 2025

Via Benzinga · January 3, 2025

MFA Financial Inc (MFA) is a specialty finance company that invests in and finances residential mortgage assets. MFA’s share price fell 0.07% in the past year from $11.07 to $10.99 as of Monday’s market close.

Via Talk Markets · December 4, 2024

Small-cap mortgage REITs TRTX, MFA, and EFC offer double-digit dividends and strategic moves in a volatile market. TPG focuses on capital recycling, MFA on residential investments, and Ellington on high-yielding credit strategies for potential growth.

Via Benzinga · August 21, 2024

MFA stock results show that MFA Finl beat analyst estimates for earnings per share and beat on revenue for the second quarter of 2024.

Via InvestorPlace · August 8, 2024

Via Benzinga · July 21, 2023

Companies Reporting Before The Bell • Indivior (NASDAQ:INDV) is likely to report quarterly earnings at $0.28 per share on revenue of $260.00 million.

Via Benzinga · February 22, 2024

Mortgage REITs can be great investments, but the timing still isn't right.

Via The Motley Fool · April 19, 2023

Analysts are predicting trouble for commercial real estate, but investor Barry Sternlicht believes he can capitalize on it with MFA stock.

Via InvestorPlace · March 27, 2023

The mortgage business is in a bad spot right now and these REITs are likely to take a hit.

Via The Motley Fool · January 10, 2023

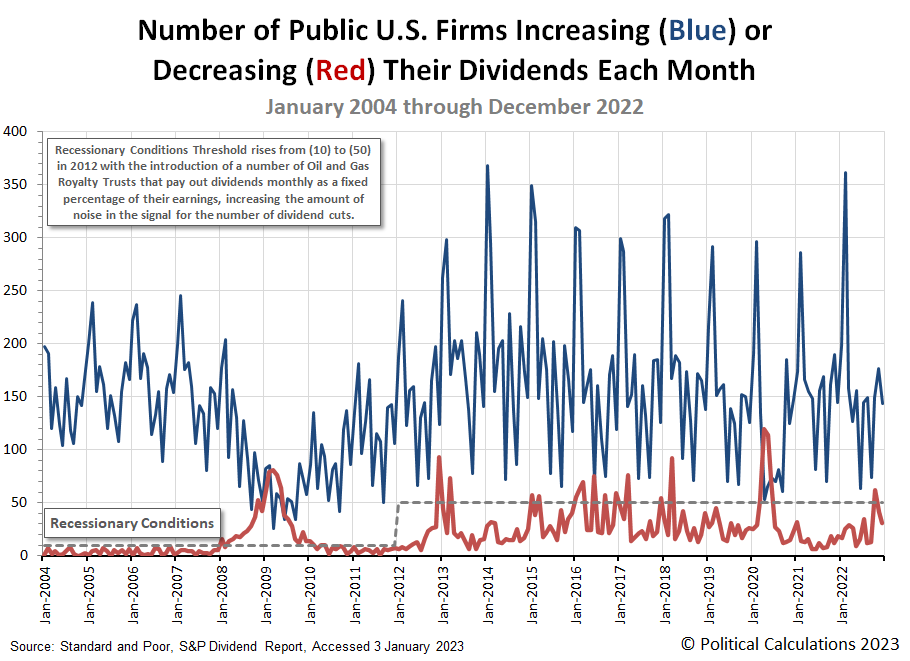

Dividend-paying stocks in the U.S. stock market closed in December 2022 with a mixed showing.

Via Talk Markets · January 5, 2023

A security pattern traces the distinct movements of security prices that, once recognized, help traders to make informed trading decisions. Here is a closer look at some REIT opportunities that may be revealed by analyzing these patterns.

Via Talk Markets · December 18, 2022

During Fed tightening cycles due to inflation, real estate investment trusts posted positive total returns in 85% of periods with rising Treasury yields from the first quarter of 1992 to the fourth quarter of 2021, according to Nareit.

Via Benzinga · December 15, 2022

Companies Reporting Before The Bell • ChipMOS TECHNOLOGIES (NASDAQ:IMOS) is likely to report earnings for its fourth quarter.

Via Benzinga · February 23, 2023

MFA has a big dividend, but will be vulnerable in a recession.

Via The Motley Fool · December 14, 2022