Latest News

While the streaming pioneer's underlying business is executing well, intense competition could compress its premium valuation over the next five years.

Via The Motley Fool · March 9, 2026

The cloud monitoring specialist's revenue growth accelerated recently, making the growth stock's pullback an intriguing opportunity.

Via The Motley Fool · March 9, 2026

Customer experience management platform Sprinklr (NYSE:CXM) will be reporting results this Wednesday before market open. Here’s what you need to know. Sprink...

Via StockStory · March 9, 2026

Personalized clothing company Stitch Fix (NASDAQ:SFIX) will be reporting earnings this Wednesday after market hours. Here’s what to look for. Stitch Fix beat...

Via StockStory · March 9, 2026

Via Talk Markets · March 9, 2026

Young adult apparel retailer Tilly’s (NYSE:TLYS) will be reporting earnings this Wednesday afternoon. Here’s what investors should know. Tilly's beat analyst...

Via StockStory · March 9, 2026

Packaged food company Campbell's (NASDAQ:CPB) will be reporting results this Wednesday before market hours. Here’s what to expect. Campbell's beat analysts’ ...

Via StockStory · March 9, 2026

Automation software company UiPath (NYSE:PATH) will be reporting results this Wednesday after market close. Here’s what you need to know. UiPath beat analyst...

Via StockStory · March 9, 2026

Workforce housing company Target Hospitality (NASDAQ:TH) will be reporting earnings this Wednesday before the bell. Here’s what to expect. Target Hospitality...

Via StockStory · March 9, 2026

Via Talk Markets · March 9, 2026

Via Talk Markets · March 9, 2026

Pet-focused retailer Petco (NASDAQ:WOOF) will be announcing earnings results this Wednesday after the bell. Here’s what to look for. Petco met analysts’ reve...

Via StockStory · March 9, 2026

The tech titan is chasing market share with a brand new MacBook model.

Via The Motley Fool · March 9, 2026

Solana and Ethereum led gains among major altcoins, each rising more than 4%.

Via Stocktwits · March 9, 2026

These three midstream stocks are high-yield darlings.

Via The Motley Fool · March 9, 2026

Via Talk Markets · March 9, 2026

Both retail giants are posting impressive growth and leaning into digital channels, but one appears slightly more attractive as an investment idea.

Via The Motley Fool · March 9, 2026

President Donald Trump may have signaled that the war in Iran is almost over, but cryptocurrency bettors don't see an official declaration of the end of hostilities before this month.

Via Benzinga · March 9, 2026

Meta Platforms denied rumors that CEO Mark Zuckerberg sidelined Chief AI Officer Alexandr Wang, with the company saying reports of a power shift were false and that Wang continues to lead key AI initiatives despite speculation triggered by a recent team restructuring.

Via Benzinga · March 9, 2026

ARK Investment extended its broader buying streak, accumulating more than 835,000 shares last week.

Via Stocktwits · March 9, 2026

Via Talk Markets · March 9, 2026

JPMorgan CEO Jamie Dimon starts his day around 5 a.m., dedicating hours to reading, exercising, and uninterrupted focus, a pre-dawn routine shared by other top executives that helps maximize productivity and effectiveness.

Via Benzinga · March 9, 2026

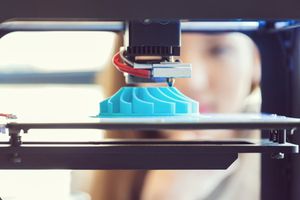

The 3D printing pioneer's losses are shrinking.

Via The Motley Fool · March 9, 2026